Structure Tomorrow's Success: Exactly how to Save for College Costs

Wiki Article

Structure a Solid Financial Structure for University: Top Approaches for Smart Planning

As the price of university continues to rise, it has ended up being progressively vital for pupils and their households to construct a strong financial structure for their higher education and learning. In this conversation, we will certainly check out the top approaches for wise economic planning for university, consisting of setting clear goals, comprehending university expenses, producing a spending plan and cost savings strategy, exploring scholarships and grants, and thinking about pupil car loan choices.Establishing Clear Financial Goals

Establishing clear monetary goals is a vital action in effective economic planning for college. As trainees prepare to begin on their college trip, it is critical that they have a clear understanding of their monetary goals and the steps needed to attain them.The very first facet of establishing clear financial objectives is defining the expense of university. This includes investigating the tuition charges, holiday accommodation costs, textbooks, and various other assorted expenses. By having a detailed understanding of the economic requirements, students can set realistic and attainable goals.

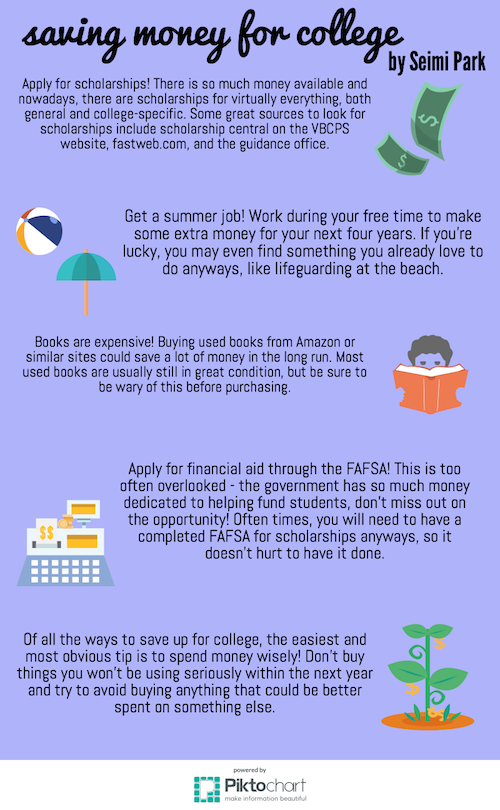

Once the cost of college has actually been identified, trainees need to establish a budget plan. This entails evaluating their income, consisting of scholarships, gives, part-time work, and adult payments, and after that designating funds for required costs such as food, real estate, and tuition. Creating a budget plan assists trainees prioritize their investing and guarantees that they are not spending beyond your means or collecting unneeded debt.

Additionally, setting clear monetary objectives also involves determining the requirement for cost savings. Students should figure out just how much they require to save each month to cover future expenses or emergency situations. By establishing a cost savings objective, trainees can create healthy economic routines and plan for unpredicted scenarios.

Understanding University Expenses

Comprehending these prices is vital for effective financial planning. It is crucial for pupils and their households to thoroughly research study and recognize these expenses to develop a reasonable budget plan and monetary strategy for college. By recognizing the different components of college prices, people can make enlightened decisions and stay clear of unnecessary monetary tension.Creating a Spending Plan and Cost Savings Plan

Producing an extensive budget and savings plan is crucial for reliable financial preparation during university. As a trainee, managing your funds can be difficult, however having a budget in position will help you remain on track and avoid unnecessary debt. The initial step in creating a spending plan is to determine your revenue and expenses. Start by providing all your income sources, such as part-time work, scholarships, or financial assistance. Next, make a list of your monthly expenses, including tuition charges, accommodation, textbooks, transportation, and individual expenditures. It is necessary to be realistic and prioritize your requirements over wants. Once you have a clear understanding of your revenue and expenses, you can designate funds appropriately. Reserve a part of your income for financial savings, emergency funds, and any type of future expenditures. It is also vital to routinely evaluate your spending plan and make modifications as needed. University life can be unpredictable, and unanticipated expenditures may develop. By having a cost savings strategy in place, you can much better prepare for these situations and prevent economic stress. Bear in mind, developing a spending plan and savings strategy is not an one-time job. It requires regular tracking and modification to ensure your financial stability throughout your college years.Exploring Scholarships and Grants

To maximize your funds for college, it is essential to explore offered scholarships and gives. Save for Read More Here College. Grants and scholarships are an excellent way to finance your education and learning without having to count heavily on loans or personal savings. These monetary help are usually awarded based upon a variety of aspects, such as academic accomplishment, sports efficiency, extracurricular participation, or financial demandStart by looking into grants and scholarships used by schools you want. Many institutions have their own scholarship programs, which can provide significant financial aid. In addition, there are many outside scholarships readily available from foundations, organizations, and companies. Internet sites and on the internet data sources can aid you discover scholarships that match your rate of interests and qualifications.

When obtaining scholarships and gives, it is important to pay attention to due dates and application needs. The majority of scholarships require a finished application form, an essay, letters of referral, and records. Save for College. See to it to comply with all directions meticulously and submit your application ahead of the due date to enhance your possibilities of obtaining financing

Discovering Student Financing Alternatives

When thinking about just how to fund your university education, it is necessary to discover the different options offered for pupil car loans. Trainee loans are a usual and convenient way for students to cover the expenses of their education and learning. It is vital to recognize the different types of student financings go to my blog and their terms before making a decision.

One more option is private pupil loans, which are given by banks, cooperative credit union, and various other exclusive lenders. These fundings typically have higher passion rates and more strict settlement terms than government financings. If government financings do not cover the full expense of tuition and other costs., personal fundings may be required.

Verdict

To conclude, developing a solid financial structure for university requires establishing clear objectives, comprehending the prices entailed, producing a budget plan and savings strategy, and exploring scholarship and grant chances. It is vital to consider all available alternatives, including pupil car loans, while decreasing individual pronouns in an academic creating style. By complying with these methods for wise preparation, students can navigate the monetary aspects of college and lead the way for an effective academic trip.As the price of university continues to increase, it has actually ended up being significantly essential for students and their families to construct a solid monetary foundation for their higher education and learning. In this discussion, we will explore the top methods for wise economic preparation for college, consisting of establishing clear objectives, understanding college prices, producing a budget and savings plan, exploring scholarships and gives, and taking into consideration trainee finance alternatives. It is essential for trainees and their families to extensively research study and comprehend these costs to create a sensible budget plan and financial strategy for college. These financial aids are usually granted based on a variety of elements, such as academic accomplishment, sports performance, extracurricular participation, or economic need.

By adhering to these methods for wise preparation, trainees can navigate the monetary elements of university and pave the means for an effective academic journey.

Report this wiki page